Choosing a wealth management firm is easy when you know which ones to avoid. This way, you can narrow down your search and be confident in your choice.

This article is about a unique wealth manager named Eric Koeplin, his past of legal battles and his current attempts at cleaning his image.

Let’s get right into it:

Who is Eric Koeplin of Denver?

Eroc Koeplin aka Eric Koeplin Alpha Principle is actually the founder of a wealth management firm called Alpha Principle.

While he has decades of industry experience in the finance sector, his last stint ended with an ugly affair.

Before launching Alpha Principle, Eric used to work at The Milestone Group. He served there for 30 years, leading the company until he was fired.

After he was forced to leave the company, he filed a lawsuit against them. However, the way he pursued the legal matter was not up to the usual standards.

He ended up settling the matter out of court (probably to save face?).

Why am I talking about him? Because he is running a reputation laundering campaign so potential investors won’t find out about Eric Koeplin’s lawsuit in Denver.

The Notorious Lawsuit of Eric Koeplin

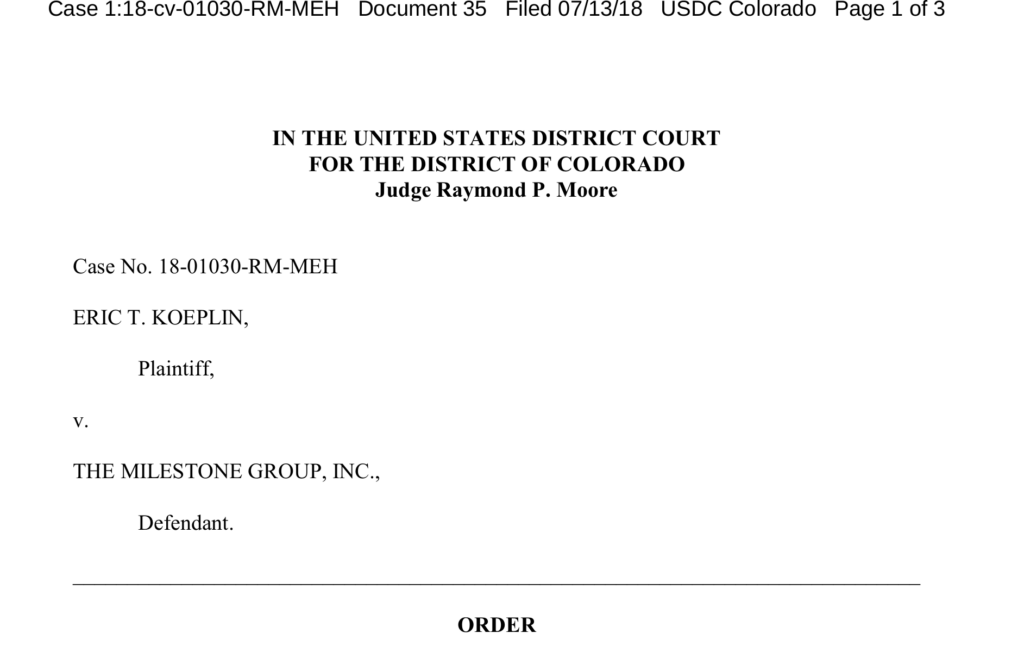

The legal case involving Eric Koeplin and The Milestone Group, specifically Koeplin v. The Milestone Group, Inc., did not result in a favorable outcome for Koeplin in terms of his immediate requests.

The court denied Koeplin’s motion for a forthwith hearing and/or expedited determination on his motion for a speedy declaratory judgment and/or a preliminary/permanent injunction. The court’s decision was based on several factors, including Koeplin’s failure to comply with local rules by not explaining whether he had attempted to confer with the defendant before filing the motion. Additionally, the court found that Koeplin did not provide a meaningful explanation for why an expedited hearing was necessary, nor did he adequately justify the imposition of the alleged unreasonable restrictions on his livelihood.

The court scheduled a hearing for August 7, 2018, to address only the request for preliminary injunctive relief, specifically focusing on whether the non-compete clause was unreasonable as a protection against trade secrets and the duties Koeplin performed while employed by the defendant. However, the specific details on the final resolution of the case, such as whether the non-compete clause was ultimately upheld or struck down, are not provided in the search results.

Eric Koeplin’s Attempt at Reputation Laundering:

To ensure people don’t find out about his shady past, Eric is engaging in a highly complicated but more dangerous activity. It’s called reputation laundering.

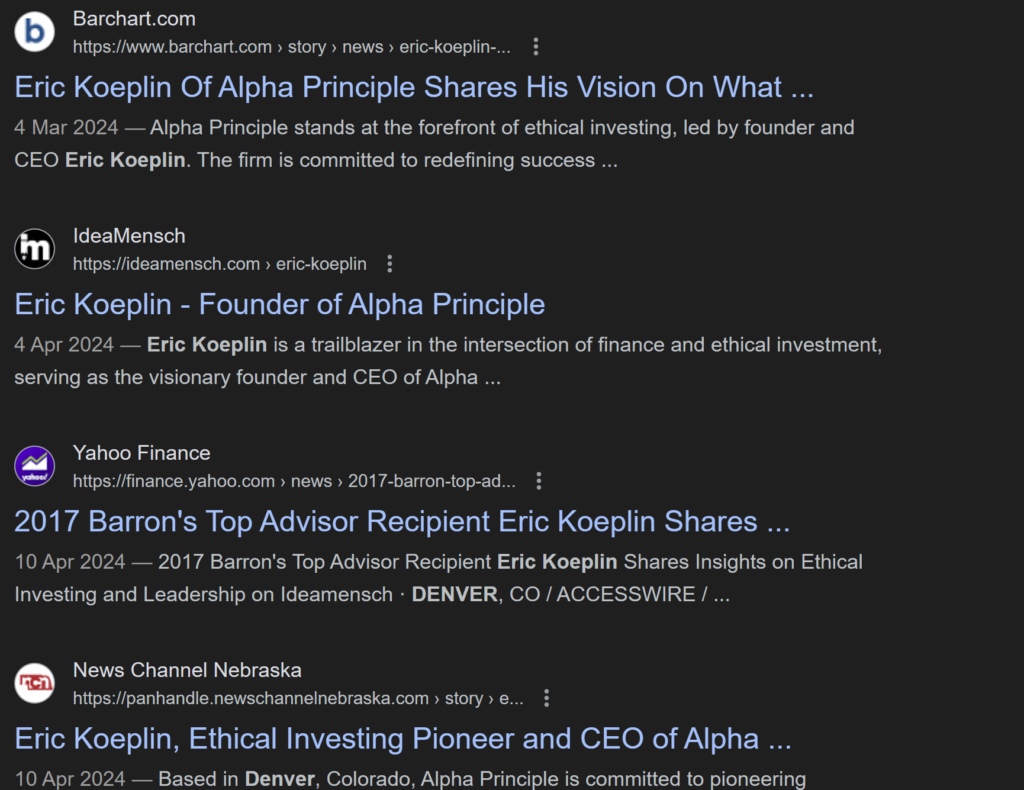

When you look up either of these keywords “Eric Koeplin Denver” or “Eric Koeplin Alpha Principle”, this is what you see:

It’s a long list of paid articles meant to show him in a good light.

Reputation laundering is pretty common among scammers and criminals by the way. Some examples include Raymond Khan and Chris Hattingh.

What is Reputation Laundering?

Reputation laundering refers to the process of improving or restoring the public image of a person, company, or nation, especially after incidents that may have tarnished their reputation. This practice can involve a range of activities, from legitimate public relations campaigns to more ethically dubious practices. Here’s a detailed look at how reputation laundering works and some of its key aspects:

Methods of Reputation Laundering

- Public Relations Campaigns: Engaging in intensive PR campaigns is a common method. This might involve press releases, interviews, or public appearances that highlight positive achievements or show remorse and reform.

- Media Manipulation: This can involve paying for positive news coverage, influencing journalists, or using legal means to suppress negative information. Social media platforms can also be used to shape public perception through targeted ads and content.

- Charitable Activities and Sponsorships: Entities may engage in high-visibility charitable work or sponsor events that aim to associate their name with positive community impact, thereby distracting from negative aspects.

- Legal Actions: In some cases, organizations or individuals might use litigation to threaten or silence critics. This can also include the use of non-disclosure agreements to legally prevent the sharing of damaging information.

- Strategic Alliances: Forming partnerships with well-respected organizations or individuals can also serve as a way to enhance one’s image by association.

- Crisis Management: Hiring specialists to handle crisis situations can help mitigate the impact of scandals or other reputation-damaging events. These experts work to control the narrative, often focusing on transparency and swift corrective action as a way to rebuild trust.

Ethical Considerations

The ethics of reputation laundering are widely debated. Some view certain practices as necessary tools for correcting misunderstandings or unfairly skewed perceptions, especially in the digital age where misinformation can spread rapidly. However, others criticize reputation laundering for potentially deceiving the public, especially when it involves obscuring the truth or manipulating facts.

Certainly, it’s not a good sign that Eric Koeplin had to engage in such activities.

The Negative Effects of Reputation Laundering:

- Undermines Trust: When organizations or individuals engage in reputation laundering, especially through deceptive practices, it erodes public trust. Once stakeholders realize that efforts have been made to manipulate public perception, it can be challenging to rebuild genuine trust. This distrust can extend beyond the specific entity involved to affect entire industries or sectors.

- Compromises Transparency: Ethical transparency is crucial in maintaining fair and open communication with the public. Reputation laundering can involve hiding the truth or presenting information selectively, which prevents stakeholders from making well-informed decisions based on complete and honest information.

- Encourages Unethical Behavior: If entities successfully launder their reputations without addressing the underlying issues that caused their reputational damage, it may encourage them and others to continue engaging in unethical or harmful behaviors, believing they can always “clean up” their image later without real accountability or change.

- Distorts Public Perception: By manipulating media and public perception, reputation laundering can distort reality, leading the public to support businesses, leaders, or policies based on false premises. This distortion can lead to misinformed public opinion and poor decision-making at both individual and societal levels.

- Hinders Justice and Accountability: When reputation laundering is used to cover up misconduct—whether it’s corporate malfeasance, political corruption, or other wrongful actions—it can hinder the processes of justice and accountability. Victims of wrongdoing may find it harder to get justice if the perpetrator successfully “cleans” their image without addressing the harm caused.

- Resource Misallocation: The resources used for reputation laundering—financial, human, and time—could be better spent addressing the root causes of the negative perception, such as improving corporate practices, enhancing product quality, or engaging genuinely with community concerns.

- Creates Cynicism: Over time, repeated instances of reputation laundering can lead to widespread cynicism among the public towards media, governments, corporations, and other institutions, reducing engagement and participation in civic activities.

Reputation laundering is a complex field intersecting public relations, ethics, and sometimes legal strategies. It remains a contentious topic, particularly in cases where the line between image management and deceptive manipulation is blurred.

Can You Trust Someone who Sues Their Employer?

Usually, it doesn’t matter if someone has sued their past employer or not. However, in the case of Eric Koeplin Denver, it’s worth mentioning that his target audience is High Net Worth Individuals only.

According to his company, their ideal customer should have a net worth of $10 million.

With that kind of money, is it okay to trust someone who files lawsuits so carelessly?

The way the court responded to Eric Koeplin’s motions goes to show how poorly he had filed the lawsuit. Such carelessness might be detrimental to a multi-million portfolio.

Furthermore, his attempt at cleaning up his reputation so no one finds out about the lowly lawsuit is another red flag.

Conclusion: Make Financial Decisions Wisely

Considering how the haphazardly Eric Koeplin of Denver sued the Milestone Group goes to show his lack of professionalism. Personally, I don’t think it’s okay for a financial advisor to be so careless.

The court rejected his claims left and right.

While I’m pretty sure he must be a great person to deal with, I don’t think he is that reliable for a high-net-worth financial advisor.

What do you think? Would you trust someone like that with your life savings?

Let me know in the comments.

The article does a great job highlighting the complexities of reputation management in the digital age. It’s a reminder to always look beyond the surface when researching financial advisors.

I found the information on the specifics of the lawsuit and reputation laundering particularly informative. It’s important for these matters to be transparent for potential clients.

It’s always critical to perform due diligence, but this article shows that we might need to dig a little deeper beyond what we find in a simple internet search. Thanks for the insights.

The article presents an interesting case. However, without knowing the full details of the lawsuit’s resolution, it’s difficult to make a complete judgment on the situation.

This story is a good example of why it is crucial for the public to have access to all sides of a story. Reputation laundering can make it difficult to discern the truth.

Interesting perspective on the topic of reputation management. It’s critical for investors to be wary of these tactics and to conduct thorough due diligence.

The article highlights an important issue in the digital age. Reputation laundering can significantly impact public perception, and it’s essential to consider both sides of the story.

This piece sheds light on the complexities of modern public relations. It underlines the importance of researching before making investment decisions.

The case of Eric Koeplin underscores the intricate dance between legal battles and public image. It would be interesting to follow this story and see how it develops over time.

The article presents a compelling look into reputation laundering. It’s a reminder that the information we see online may not always present the full picture.